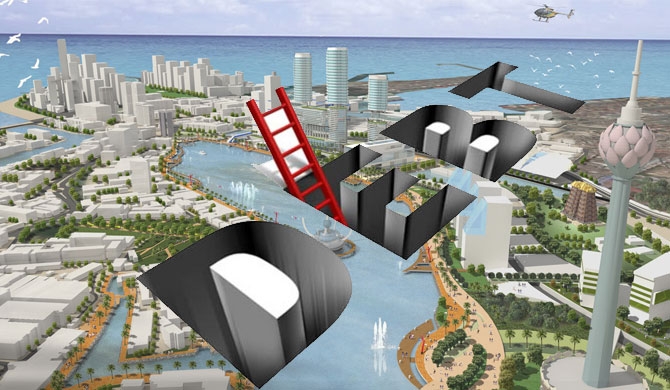

Sri Lanka's debt burden solely due to Chinese loans or not?

A discussion facilitated by the economic think tank Verité Research recently pointed out that entangling Sri Lanka in the debt web is not loans from China but those from international finance markets, where the lending rate is higher and the refinancing period is shorter.

To be specific, analysis show that almost 50 percent of Sri Lanka’s debt is to international financial and bond markets; it has grown from almost zero percent since 2007, which is the year the nation started to issue international bonds.

The country reaps simple financial advantages in borrowing from China at 2 percent and having 19 years to settle the same, than borrowing from international financial markets at over 6 percent and having only seven years to recycle that loan.

On the face of it all, the deal with China seems to be just right if understood proper. However, the primary issue is not even about the amount of loans taken to develop infrastructure. The real issue, according to economists, is the governance side of it, which surprisingly, isn’t harped on much by the groups that point out the influx of loans.

Over the years, Sri Lanka has witnessed a hue and cry on the perception that China is silently taking ownership of the island nation to reap the benefits of the strategic location, while extending never ending loans.

The continuous granting of loans has left a large section of the country worried as it is assumed that the economic giant literally shoving down Sri Lanka’s throat more than it can swallow and thus entangled in a deadly debt trap.

Real issue with China

According to Verité Research Executive Director Nishan de Mel, while there are some very significant benefits in the cost and duration of debt from China, there are significant issues with the projects that have been financed with those funds.

According to a study carried out by the University of Moratuwa, it is revealed that the cost of building roads has escalated at an alarming rate, where Chinese-funded roads tend to be much more expensive than those funded by other institutions, such as the Asia Development Bank, for instance. The increase in costs is noted to be more prevalent in the debt that is bilaterally governed and it can be traced back to the Chinese.

“It is clear that bilateral funding is escalating the cost of actually delivering or completing the project, which is a huge disadvantage for the people of the country,” shared de Mel, at a forum on China’s Belt and Road Initiative (BRI), held recently.

The practice in multilateral funding is that they give checks and balances to some extent to mitigate the problems in the case of Sri Lanka, it was pointed out that just because the debt is cheap, it doesn’t necessarily mean it is good, since the cost of initial capital is unreasonable.

The issue with such kind of money is that when it interacts with poorly governed countries, it can significantly compromise the benefit that accrues to people, professed de Mel.

China‘s ‘no interfering’ stance

The fact that the Chinese government hides behind the rubric of not interfering in local affairs, on the basis that Sri Lanka has a democracy and the country determines the government, is said to be “slightly problematic”.

According to de Mel, it is awkward the position the Chinese government is taking, that democracy is maintained if they are getting a good outcome, because it ignores the problem of poor governance. The economist stressed that interacting with easy money causes adverse outcomes for the people in the country.

Comparing China’s position with the West, in countries such as the US and UK, laws are passed to criminalize the rivalry of their firms, even in third countries. The reason being, it has been acknowledged that money in large sums creates the opportunity to go corrupt at some instances. And it is no different for Chinese entities.

“You only need to look at the cost of building a railway line to Mannar to realize the cost escalation,” quipped de Mel.

“This is not a unique China issue. When you have unregulated bilateral debt entering a country, without concern about the governance it is interacting with, such is only likely,” he added.

Be more concerned

While getting on with one’s agenda and one’s agenda alone might seem healthy, turning a blind eye on the rest, especially the countries China is financing, is detrimental. It was asserted that the Chinese government taking no responsibility in implementing an extremely large transfer of financing system to the poor world is a matter of serious concern. In this regard, China must take responsibility as other countries have taken, according to the think tank.

“We must protect our democracy. Our democracy cannot become the playground of international capacity to buy out politicians.

“That is a threat we face inherently with the existence of a large amount of international funding that can flow into countries at will and is not accountable to anyone. And certainly the people don’t have the capacity to hold anyone accountable,” de Mel opined.

However, it was pointed out that on the positive side, China has shown great many changes in the way it responds to concerns to the world, such as environmental issues. But on the case of governance, it is yet to respond in a positive manner and take corrective measures.

Beyond top line investment numbers that have been announced by the Chinese officials and the occasional projection on intended country-level investment under the initiative, the BRI project information is not centrally reported. Furthermore, while the Chinese policy and commercial banks will sometimes make public announcements about project investments, this is not done consistently and specific financing agreements are rarely published.

Meanwhile, it is also uncommon for the debtor countries to fully and completely disclose loan information.